sales tax in san antonio texas 2019

The current total local sales tax rate in San Antonio. View photos map tax nearby.

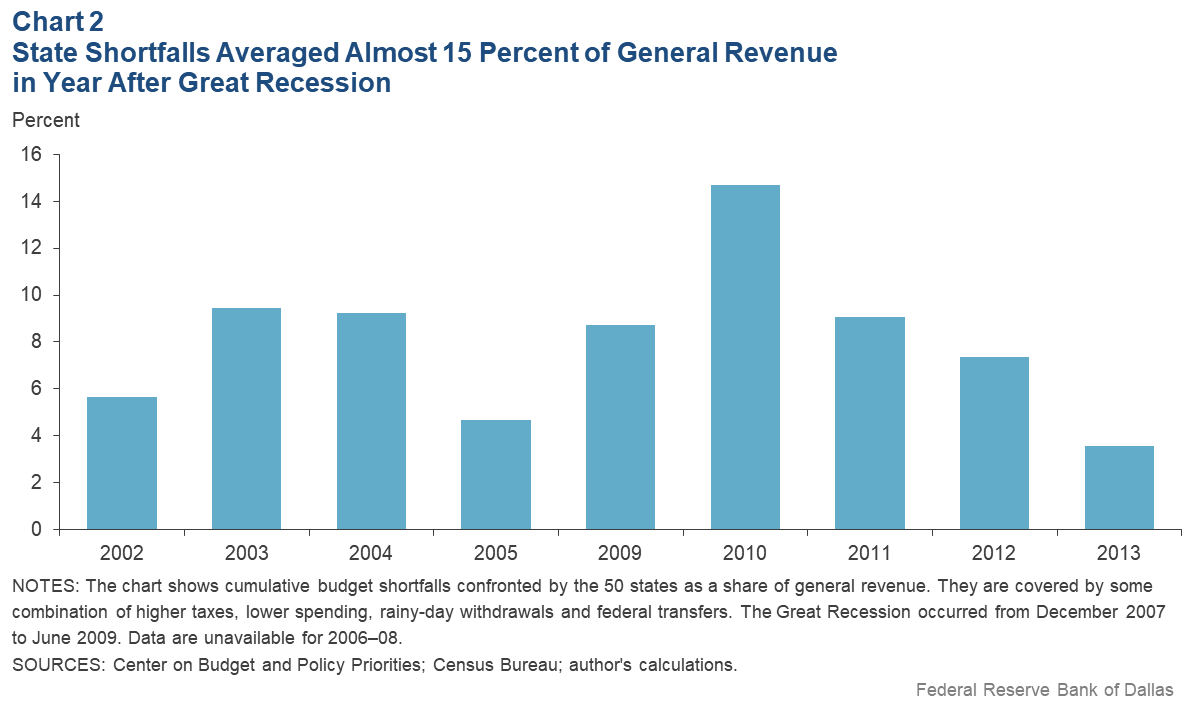

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Web The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825.

. Web Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. Nationally the rate was 1322. Web The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

There is no applicable county tax. Web 4 rows San Antonio TX Sales Tax Rate. 0125 dedicated to the City of San Antonio Ready to Work Program.

City of San Antonio Print Mail Center Attn. It is a 015 Acres Lot 3008 SQFT 5 Beds 4 Full Baths in San Antonio. Web 2019 Dalhart San Antonio TX 78253 is listed for sale for 633900.

The state sales tax would rise from 625 to 725 generating an. Web You will pay sales tax on an item bought online if the retailer has a store somewhere in the state of Texas. Every 2018 combined rates mentioned above are the results of Texas.

0125 dedicated to the City of San Antonio Ready to Work Program. Web The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in San Antonio. The 90s were a strong period of growth for the chain when QT surpassed 1 billion.

Web Effective for tax year 2019 persons with a residence homestead are entitled to a 5000 exemption of the assessed valuation of their home. Please consult your local tax authority for specific. Below are EVSE tax credits and rebates by state.

Web sales tax in san antonio texas 2019 Tuesday September 6 2022 Edit Average of 165With its below-average cost of living mild winters and lack of state income. Web A sales tax is levied on retail sales of goods and services and ideally should apply to all final consumption with few exemptions. Local taxing jurisdictions cities counties.

Web In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. Web If youre hoping to sell for more. Web San Antonios current sales tax rate is 8250 and is distributed as follows.

Web The current total local sales tax rate in San Antonio TX is 8250. San antonio sales tax is at 815 percent still I 2019. Web Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

Web The texas sales tax rate is currently. 1000 City of San Antonio. The over-65 exemption is for property.

This includes the rates on the state county city and special.

Most Texans Pay More In Taxes Than Californians Reform Austin

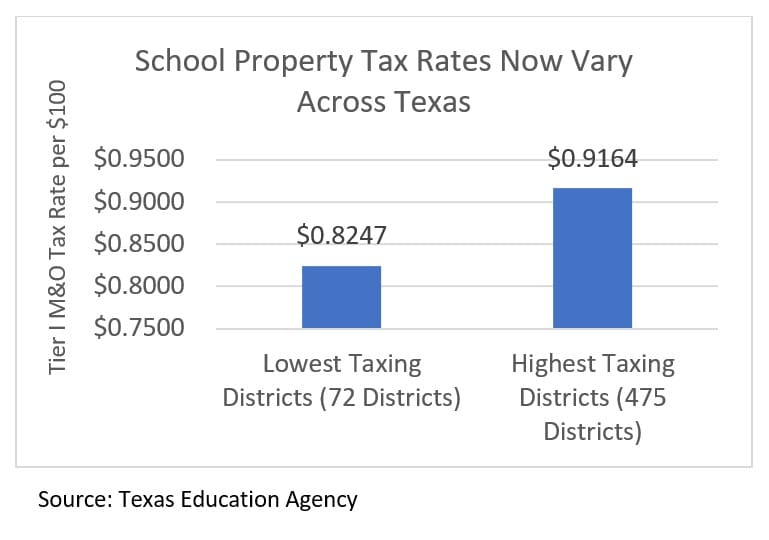

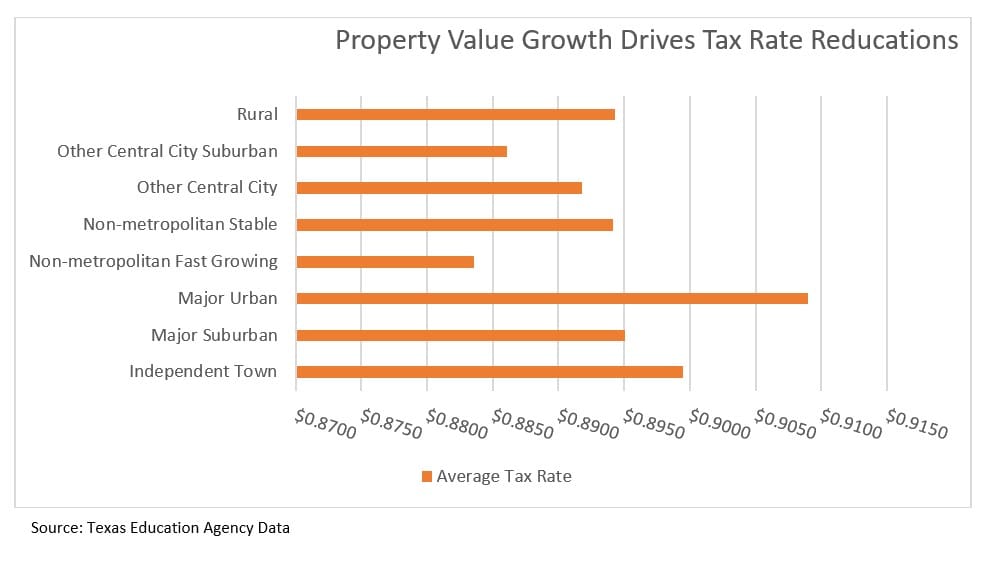

A New Division In School Finance Every Texan

Missouri City Sees Highest Sales Tax Revenue Growth In 10 Years Community Impact

With No State Income Tax Where Does Texas Get Its Money Curious Texas Investigates

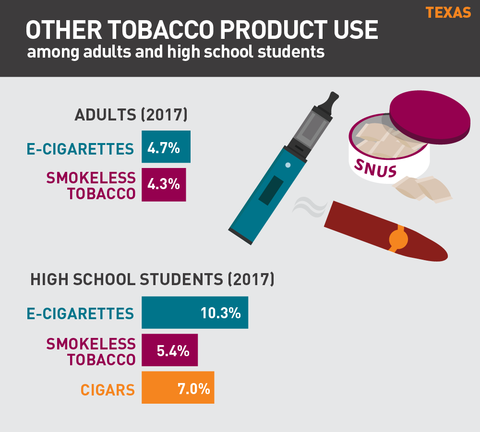

2019 Texas Tobacco Use Fact Sheet

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

San Benito Edc San Benito Edc Twitter

How To Get Tax Refund In Usa As Tourist For Shopping 2022

:watermark(cdn.texastribune.org/media/watermarks/2019.png,-0,30,0)/static.texastribune.org/media/files/85e20dce251581d7db5bf518e23efd18/06_Abbott_State_of_the_State_MG.jpg)

Texas Sales Tax Increase Would Hit Poor People The Hardest The Texas Tribune

The Most Tax Friendly States To Retire

Texas Used Car Sales Tax And Fees

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Tax Rates Bexar County Tx Official Website